A 2021 QUESTION

HOUSING, A LOST CAUSE?

THE UNCOMFORTABLE CONVERSATION ANYONE UNDER 40 IS HAVING WITH THEMSELVES

June 14/2021

LOST IN THE SEA THAT IS THE HOUSING MARKET?

Have you ever had a conversation with life that goes something like this…

You “I’d really love to own a house one day”

Life “Those start at $700,000 you know…”

That’s the first thing A Generation Adrift ever posted but depending on where you live you sadly may have said “I wish I could get a house that cheap…”

I live in Toronto, Canada eh and at in 2021, my wife and I decided to look at condos. We knew we couldn’t afford it but we figured it would be fun… We were wrong.

After finding shoe box, bachelor condos for over $500,000 and one bedrooms that require finding the lost city of Atlantis as a down payment, we finally found something we could afford… A parking space… For $70,000. “What is this? An apartment for ants?!” – If you got that joke, congrats, you’re a millennial.

So naturally, as the real possibility of being forever priced out of the housing market dawned on us, we started to wonder… “Are we screwed? Is our generation screwed?”

Let’s find out.

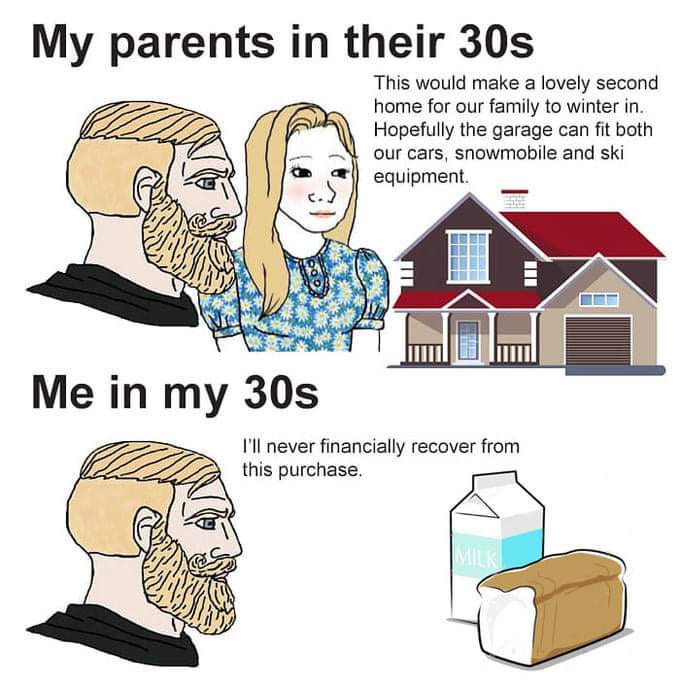

We can argue all day

about if this meme is true but at the end of the day… It’s how it feels to Millennials and Gen Zers.

And can you really blame us? After all theaverage cost of a house in America is up 33% compared to when the last housing bubble burst back in 2008 while minimum wage is up just 70 cents.

And in Canada it’s even worse with the average cost of a house going up an INSANE 31.6% from LAST YEAR ALONE but minimum wage went up a quarter, so we’ve got that going for us, which is nice… But the average cost of a home in the ‘Great White North’ is $716,828.

So yes, I would argue this meme is true. But again, if it isn’t ‘that bad’, can you blame us for feeling like it is?

Let’s take a quick detour for some fun… Math.

It’s no secret that back in our parents generation, you could work just about any job and barring that you didn’t lose your money to something stupid or unfortunate, you could carve out a decent living with a spouse, 2 kids, a mortgage and car payment on one salary.

On Feb 1970 Minimum wage in America was $1.45/hr or $3,016/year (before taxes). The average cost of a house was $17,000. So if you didn’t pay taxes (we are NOT recommending that) and you put every penny you had into your house then it would take you a little over 5 and a half years to pay it off, 5.636 years to be exact.

Now for the fun exercise. Current US minimum wage is $7.25/hr or $15,080/yr (before taxes). The average cost of a house is $269,039, so without paying taxes and putting every penny into a house, it would take you almost 18 years to pay it off. Exactly 17.84 years. That’s over triple what it was for our parents generation.

I can already hear the argument “most people make more than minimum wage” which is true. Okay, let’s do it. In 2020 the average person in America made $51,168/year or 5.25 years of wages to pay off a house compared to 1970 ($9870), where it would take you 1.72 years.

In Canada minimum wage in 1970 was $1.50/hr (province depending) or $3120/yr. Average house cost $29,429. Same math : 9.43 years to pay it off. Minimum wage in 2020 : $14.50/hr or $30,160/yr. Average house cost : $716,828. Same math : 23.76 years. Okay, average wage time, 2020 -$54,630 or 13.1 years of wages to pay off a house. Compared to 1970 where average wage was $25,771 or 1.14 years of wages… Are we starting to see a pattern yet?

Don’t even bother trying without

a loan from the BOMAD. Now you may be saying ‘What is that? A bank? Never heard of it.” And I don’t blame you. It’s a newly minted term in the housing market The Bank Of Mom And Dad. This is what banks are telling people in their 20s and 30s, that because of housing costs it’s not even worth trying to buy something unless you have parents that are well off enough to help you with the mortgage, including co-signing. (Global news wrote a fantastic article about this).

All of this frustration has boiled over and you know who sadly takes the charge of social change these days? No, not the government (that’s cute though).

We do…. Or more specifically, Reddit does.

This is a billboard that was bought and paid for by people in our generation and displayed in Toronto, Canada where housing prices are now so expensive they’re listed in human souls and lost treasures that only Indiana Jones would be able to find instead of dollars.

Others have popped up in major cities as well reading…

“Homes are for investors. Families can go rent”

and

“Homes aren’t for you, they’re for the rich, you can rent”

Now just incase, let me ask you again… Even if the housing crisis isn’t as bad as they say it is, can you blame us for feeling that way?

And just to be clear, it is as bad as they say it is. But alright, we can’t leave it there. It’s not the Generation Adrift style. Where’s the silver lining? Admittedly, it’s not easy to see in this case but let’s leave you with the list of advice for buying a home told by The British Columbia Superintendent Of Real Estate.

– Understand the risks of subject-free offers. Seek professional advice before making one, proceeding without financing in place, or without having the home inspected.

– Be realistic about what you can afford. Work within a sustainable budget and be aware of the extra costs not associated with the listing price, like closing or inspection costs.

– Ask questions to ensure you’re comfortable with the listing price and marketing strategy. Buyers should ask their real estate agent about the market value of the property they are considering, and how market conditions are affecting pricing.

– Be prepared in a multiple offer scenario. Ask your real estate agent about what to expect in theoffer process. Discuss ahead of time how you will manage a multiple offer situation.

Thank you for taking the time to read our ramblings. I know this one is bleak, trust me, we feel it too but we’ll be talking more about housing and affordability with professional economists in future episodes of the A Generation Adrift podcast. Be sure to stay tuned!

As always, transparency is a key goal of ours. Here’s our references for the write up.

BC recommendations when buying a house/condo